We had a thorough meeting with Esensorics business project owner and the team, after which we made improvements to the canvas. In the meantime we have also focused on developing further the most important part of the system.

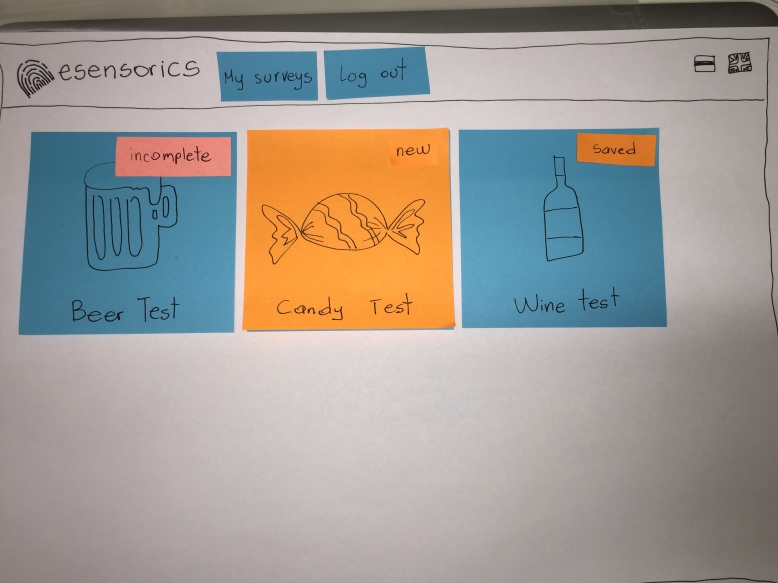

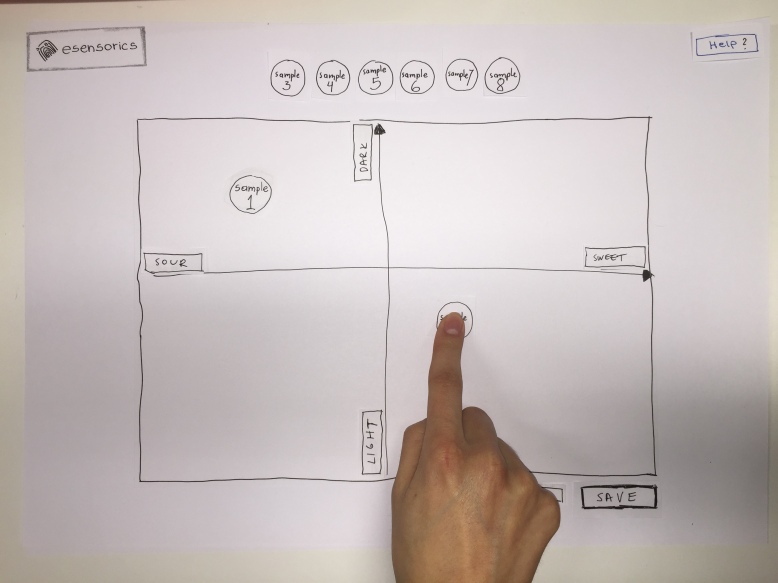

We decided to focus on the survey participant (taster) side and even more specifically, in the following weeks to focus more on the part where user can play with placing different products in multiple self-created axis.

Business canvas

After validating the business canvas with Esensorics business team, we have made many changes and improvements to the canvas. The new and updated version 4 is available here: http://leanstack.com/canvases/200027.

Analogs and antilogs

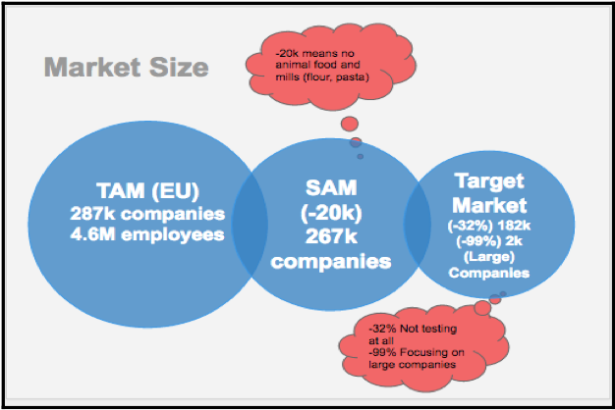

During meetings we raised a question what is the current uniqueness of Esensorics system. We found it difficult to differentiate it from survey management tools. For survey management, anyone could use famous tools like Surveymonkey.com or Google Forms for more simplistic ones. The business owner found it also difficult to explain why any food company should use their survey system instead of Surveymonkey or other similar tool, for technical solution. We proposed that they should work more on the food industry specific functionality, like pre-defined and recommended parameters and scales for food tasting, or good quality assurance or management dashboards for constant monitoring of production quality. Such functionalities would definitely create a food industry specific competitive advantage.

In the analogs and antilogs part we are still focusing on the sensory analysis tools.

Analogs

Lapka

To test the “nitrate concentration” takes food testing into an innovative turn that empowers the customer to give an informed decision about organic food, considering all the law sues that have appeared overtime against food companies that claimed that their products were 100% natural.

Ratebeer

From the large amounts of information to the personalized ratings and social interaction, ratebeer has proven to be a potentially successful project that may not focus on professional food testing, but it provides for sure a source of opinions and experience that are helpful to guide newcomers and food enthusiasts in their search for different flavors and emotions.

SIMS Sensory Software

SIMS software provides the solutions to meet research needs. By continually and consistently making improvements to its product line, and using the newest available hardware and software technologies, Sensory Computer Systems maintains its leading-edge position in the automation of Sensory and Marketing Research.

Creators mostly focused on to create flexible, easy to use, bug free and affordable product. Based on the client comments on their website we learn that value for the price paied and the willingness of SIMS personnel to customise to the needs to clients are two most important things, clients are looking for while taking for the too. Even though SIMS Sensory solution can’t brag with the huge amount of subscribers it still managed to maintain reputation by delivering quality service.

Compusense

Originally established in Canada Compusense is another tool for the sensory analyses, clients of which are one of the biggest companies of the world including: Pepsi, CocaCola, McDonalds… Again the tool focuses on user friendliness and exceptional customer support service what proves that those two aspects are one of the most important issues for the customers. Compusense has been created in order to meet the business needs however their website allows everyone to download and test the free trial version of the tool in order to have an insight about the way it works. It can be listed as an analog of our solution as long as it has been operating successfully through 20 years of industry experience.

Antilogs

Tricorder device by Aydogan Ozcan

What started out as a food testing technology in the University of California evolved into a more advance medicinal instrument that has been referred as exported from “Star Trek” because of its futuristic approach to consumer interaction. As much as the development of this technology is growing strong with every year (and it’s use might become more important than food testing) it never developed into a simple application that could have enhanced the evaluation of nutritional values to the common citizen.

AgraApp

Agra specializes in nuts. Their cause (preventing food allergies) is very noble, and even more admirable when the application is free, but food testing is not made possible through this instrument, when it could have been. An opportunity has been missed, perhaps, to focus more on allergy precautions.

FIZZ by Biosystemes

Founded in 1985, Biosystemes has been developing and marketing sensory analyses and consumer test software since 1988. FIZZ fits all activities from more routinely analyses for quality control, to the more specific needs of the research centers and the universities in the various domains including the food industry as well. Creators say that they took for it because during eighties there were no tools allowing managing sensory analyses. This software solution still maintains success even after years however their focus is more on bio research, rather than on food companies. Biggest customers of the FIZZ are research centers and universities. Later on, some time after foundation, they also switched their focus towards bigger industry and expanded an operating scale on different types of products, like cars, personal care products and cosmetics.

Conclusions

It is important to identify opportunities that may come along in the design process of the interactive application in order to develop a complete and sound experience for the prospective users. More than food testing, what are the side alternatives that might evolve from it? Questions like this are to be paid attention to. Quality is another relevant element to pay attention to, since health issues are playing a very important role in the user’s life.

References

Solution interviews

When we started creating user stories, by creating only 50 stories that are quite general, we understood that we need to focus on some specific functionality both from testing and development purposes.

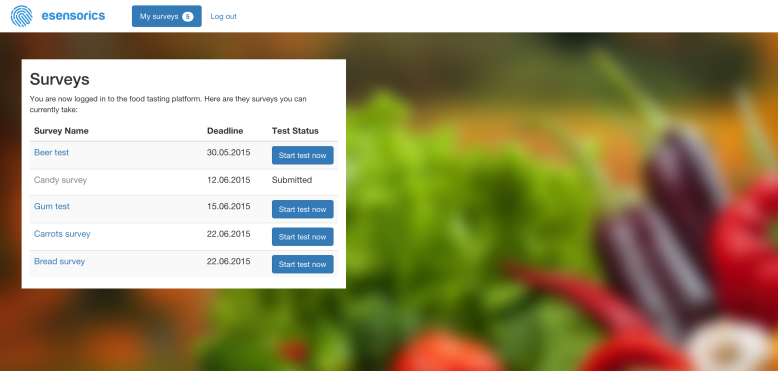

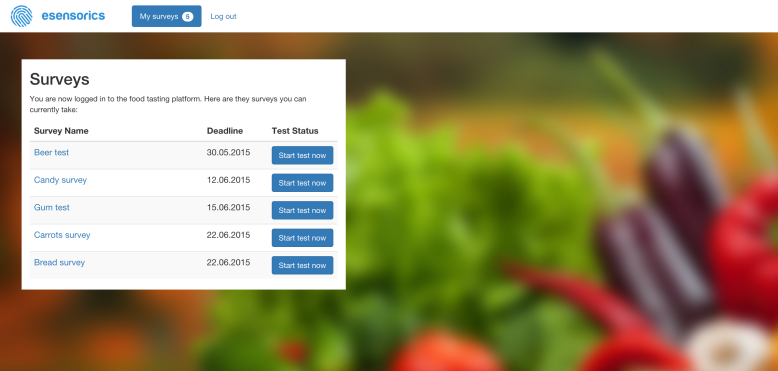

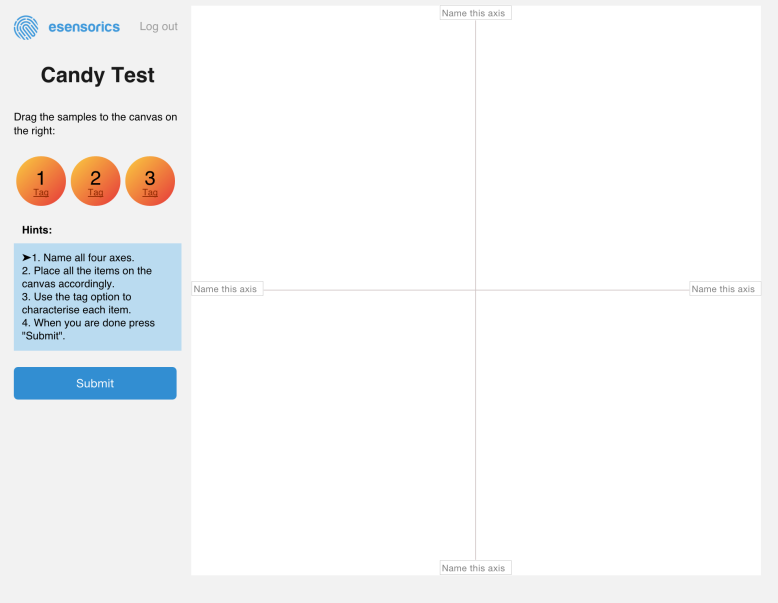

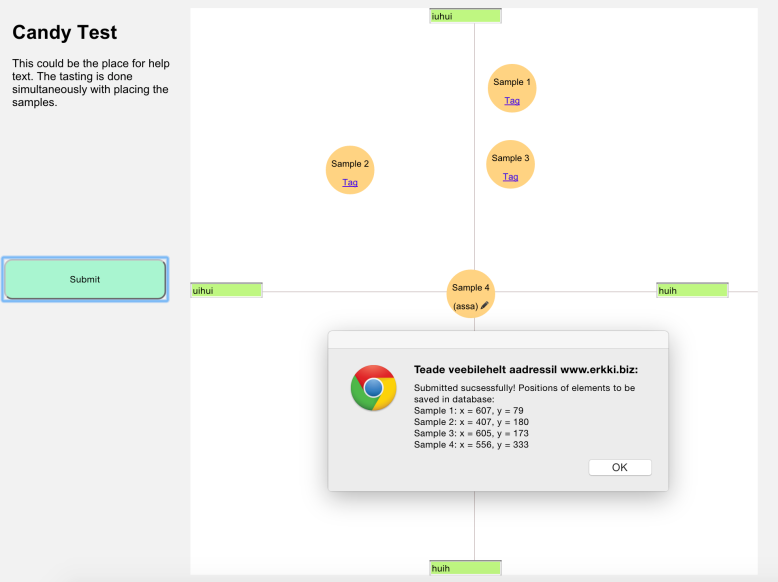

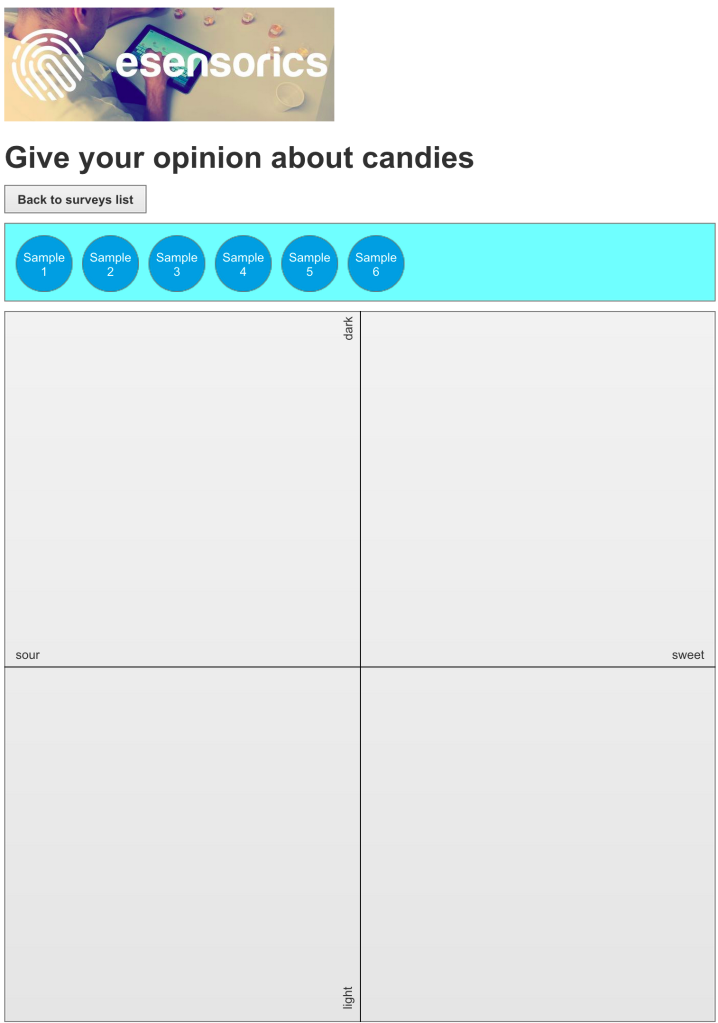

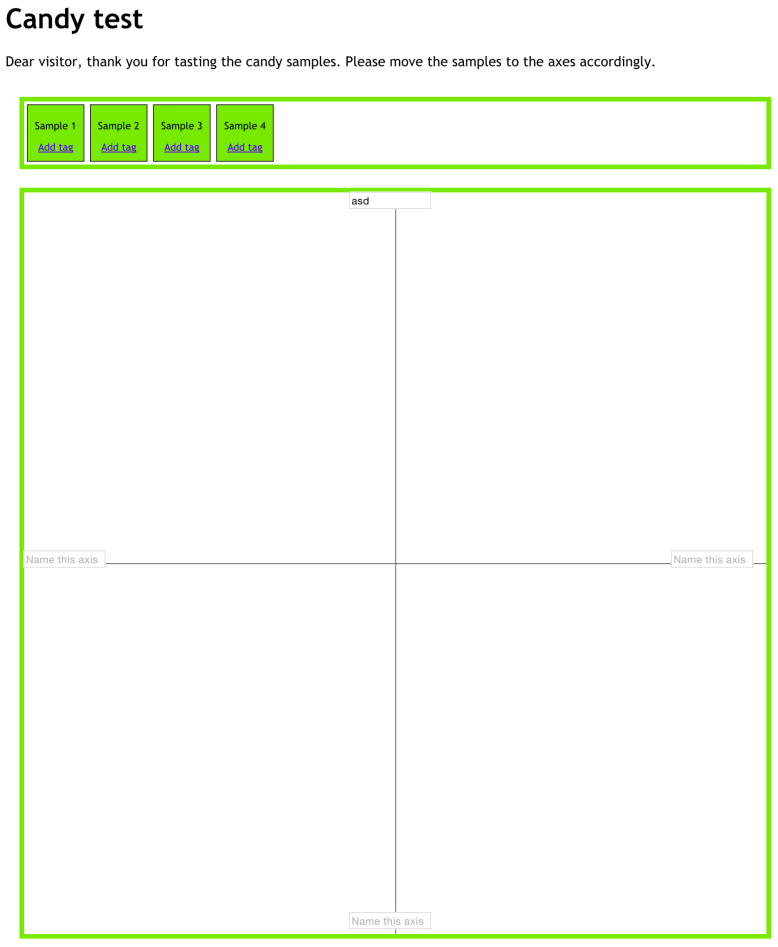

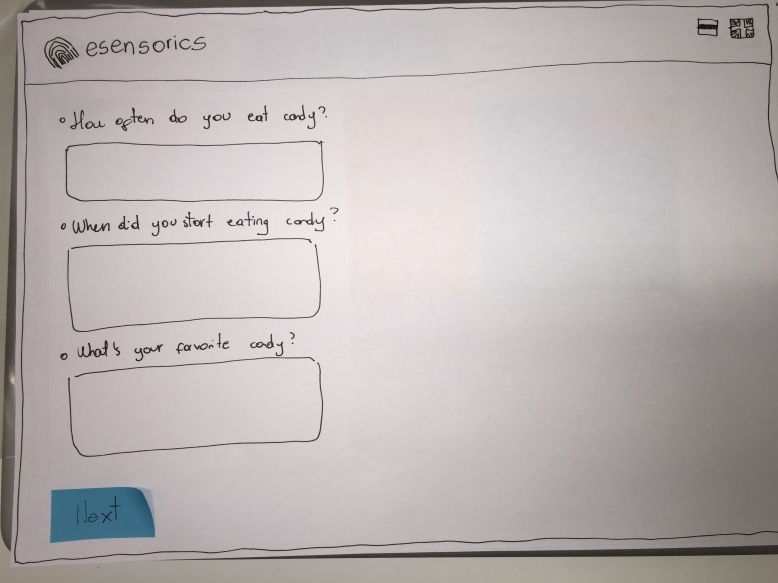

Together with Esensorics team, as mentioned before, we decided to focus on the survey participant (taster) part. We discussed about different solutions that are currently in use. The most used solutions are different form elements such as 1-5 or 1-7 selectable scales, input fields, text areas, radio-buttons and checkboxes. We found out that Esensorics is currently redeveloping a solution for visually putting tasting samples into a graph that is combined from 2 axis. The taster can name the axis as free text. Afterwards the participant can set tags to the samples and also group them by drawing a line, and then name the group. The solution has many disadvantages, out of which the biggest one seemed to be the level of difficulty and amount of time needed for the analysis of the results, as everything is in free text form. The aggregation of data is mostly manual.

During Interaction Design Methods course we had an assignment to create a paper prototype of some functionality of the system and also to create test cases. We decided to use this as the basis for our solution interviews. Instead of just testing paper prototypes, we combined the paper prototype testing with talk-aloud session and after doing the testing the subjects had to answer questions, give suggestions etc.

We chose an iterative method, so instead of testing and interviewing every participant with the same solution, we improved the solution each time after the interview and only after that made the next interview. Therefore, it cannot be called a minimum viable product finding method, rather the best solution finding method for one specific, but important part of the functionality.

In order to make the interviews more realistic, we chose very specific solution – putting tasting samples to the grid and axis; and a very specific product – tasting candies. We used 9 different candies for the participants and labeled them from 1 to 9.

The interviews were with the following structure:

- The interviewee was introduced the general idea of the system.

- The interviewee was given specific tasks (3 main tasks and for one tasks up to 3 sub-tasks) to actually do. The basis was the paper prototype.

- While performing the tasks, one team member was acting as the computer and changing slides, adding, removing or moving elements across the paper canvas based on the activities the person did.

- When the participant was in trouble, they were asked to explain their thinking behind the action.

- After concluding all the tasks, participants were asked to explain what they did and what they thought they had to achieve. We asked several specific questions from each participant based on what we thought was important to ask to get more insights.

- At the final stage, we explained what we actually wanted to achieve and wanted to happen, and asked participants to give reflection what went differently compared to what we thought, and why. Also the participants were asked to give suggestions for improving the system. Participants were asked if the solution helped them to fulfil the goal.

- After each participants testing+interview, we spent some time to discuss inside the team what was wrong and what and how to improve, made the improvements and tested them with the next participant.

Around half of the solution was changed during the interviews and a large number of elements (incl. additional information, tooltips, help texts, buttons, titles) was added.

Some examples of what we learned and improved in the system during the interviews:

- The step by step instructions and showing user where he is in the process (progress in steps) and “next” button were added and it worked well.

- Error messages should appear when a button clicked and some requirements are not filled, but they should go away right after the error reason is extinct, even without clicking the button again.

- The axis naming window will show up when the first sample is moved and system should not let them drag and drop before naming the axis to avoid confusion (so samples go back to original place).

- There are several options of grouping and none of them is the best (each of them has disadvantages). Some users prefer to use grouping with fingers by moving the items; some wanted to drag the items and drop them to “Group” icon, and some wanted to select the items and name them as groups as they wanted. Circle on the grouping icon was misleading. Group name should be set before starting to group things. It is good if different groups have different colours, although the colours should not be set until they are grouped and named already (to avoid confusing the colour name to the product’s attributes).

- Samples after moving to the desired position get a “+” sign automatically so that people would understand that more info can be added to the samples.

- Once tags are written, samples will show a number of assigned tags in a colourful circle. One tag name will stay visible next to the sample.

- Tooltip will appear while going to any place and will indicate the next step (sometimes with text fields or buttons).

- Fixed axis is also an option to consider. Did not find an ideal solution.

We can surely conclude that the solution interviews together with the actual solution prototype was a really good idea, otherwise theoretical talk would have given 10% of the value compared to what we received now. We can also conclude that it is worth developing into the product, but at the same time considering different alternatives for parts of the solution, and that can be done, for example, but letting the survey creator choose between different options.

Startup events

We decided together with Esensorics business owner that it would not be wise for us to try to sell the idea to stakeholders or potential mentors if we are not the project authors. Therefore we did not participate in any such event with the purpose of pitching the idea.

Nevertheless, two or our team members participated in the EstCHI events in Garage48 and some plan to take part in the future events such as OpenCoffee and others.

Additionally, we have tried to pitch the idea on some of our friends/acquaintances and also during the interviews to the test subjects. The topic seems interesting, but new to everyone, as nobody has ever been as a participant in such tasting sessions.